Research

Working papers

- When Does Linking Pay to Default Reduce Bank Risk? with Stefano Colonnello and Giuliano Curatola

-

Poison Bonds

with Rex Wang Renjie

Show Abstract

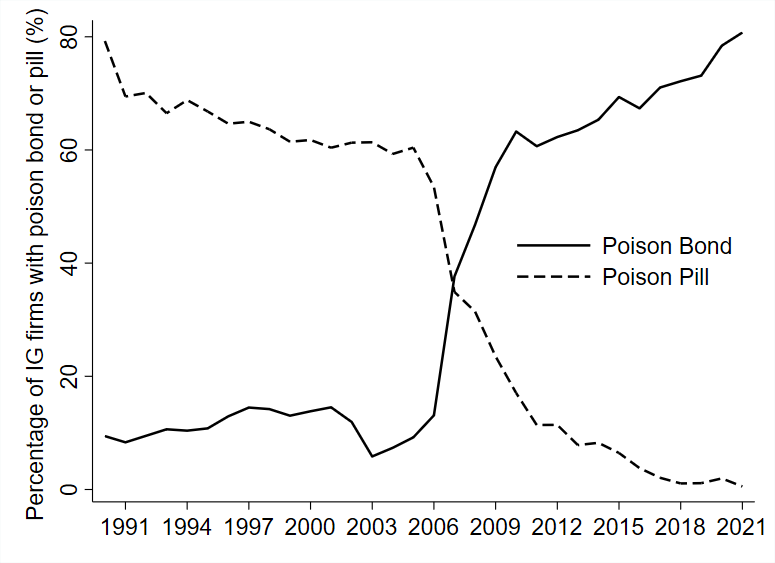

This paper documents the rise of “poison bonds”—corporate bonds that allow bondholders to demand immediate repayment in change-of-control events. The share of poison bonds among new issues has grown substantially in recent years, from below 20% in the 1990s to over 60% since the mid-2000s, predominantly driven by investment-grade issues. We show that a key factor behind this rise is shareholders' aversion to poison pills, leading firms to issue poison bonds as an alternative. Moreover, our analysis suggests that this practice can entrench incumbent managers and destroy shareholder value. Holding a portfolio of firms that remove poison pills but promptly issue poison bonds generates negative abnormal returns of -7.3% per year. Our findings have important implications for the agency theory of debt: (i) more debt may not discipline the management; and (ii) even without financial distress, managerial entrenchment can lead to agency conflicts between shareholders and creditors.

This paper documents the rise of “poison bonds”—corporate bonds that allow bondholders to demand immediate repayment in change-of-control events. The share of poison bonds among new issues has grown substantially in recent years, from below 20% in the 1990s to over 60% since the mid-2000s, predominantly driven by investment-grade issues. We show that a key factor behind this rise is shareholders' aversion to poison pills, leading firms to issue poison bonds as an alternative. Moreover, our analysis suggests that this practice can entrench incumbent managers and destroy shareholder value. Holding a portfolio of firms that remove poison pills but promptly issue poison bonds generates negative abnormal returns of -7.3% per year. Our findings have important implications for the agency theory of debt: (i) more debt may not discipline the management; and (ii) even without financial distress, managerial entrenchment can lead to agency conflicts between shareholders and creditors.- On the program of EFA (Scheduled), WFA, NYU/Penn Conference on Law & Finance, Finance Down Under, SGF, FMA Consortium on Asset Management, SFS Cavalcade Asia-Pacific, ECGC, Venice Finance Workshop, FMA Asia/Pacific

- Coverage: Institutional Investors, Harvard Law School Forum on Corporate Governance, FT Alphaville, (2x)

-

Trading Away Incentives

with Stefano Colonnello

and Giuliano Curatola

- On the program of Paris December Finance Meeting, Owners as Strategists 2024, CICF

-

Green Preferences: Evidence from the Greenium in Green Bonds

with Rex Wang Renjie

- Previously circulated under "ESG Investing Beyond Risk and Return"

- OU-RFS Climate and Energy Conference, DGF, CICF, SoFiE, FMA Europe, FMA Asia/Pacific

- Invited for the RFS Dual Submission

-

Lame-Duck CEOs

with Sebastian Gryglewicz

and Marc Gabarro

- On the program of Executive Compensation Conference, EEA-ESEM, MFA

- Coverage: Columbia Law School's Blue Sky Blog

-

Selection Versus Incentives in Incentive Pay: Evidence from a Matching Model (Under major revision)

- On the program of AFBC, DGF, Paris December Meeting

- Bureau Van Dijk Prize, 30th AFBC

Published and forthcoming papers

- The Corporate Investment Benefits of Mutual Fund Dual Holdings with Rex Wang Renjie and Patrick Verwijmeren, Journal of Financial and Quantitative Analysis, 60, 734-770 (2025)

- Nonstandard Errors with Albert Menkveld et al., Journal of Finance, 79, 2339-2390 (2024)